Redefining On-Chain Capital Efficiency with Spark Protocol

Background of Spark’s Creation

(Source: spark)

As DeFi markets continue to evolve, persistent challenges—such as low capital efficiency, idle stablecoins, and excessive yield volatility—still remain unresolved. As a comprehensive, cross-chain financial infrastructure, Spark was specifically developed to address these pain points. Rather than being just another DeFi application, Spark establishes the fundamental layer for on-chain yield and liquidity management, engineered to maximize stablecoin efficiency and optimize capital deployment.

Spark operates on the Ethereum mainnet and multiple L2 scaling chains. It delivers a unified entry point for financial liquidity. Capital is channeled toward more efficient, stable use cases.

Three Core Modules of Spark

The Spark protocol consists of three core modules, each designed to enhance DeFi’s underlying capital efficiency:

- SparkLend: Decentralized smart lending platform

Users can deposit stablecoins and major crypto assets into SparkLend to earn yield or use them as collateral for borrowing. The platform supports high-efficiency lending (E-Mode), asset isolation, and isolated asset strategies, enabling effective risk management and improving overall capital utilization. - Spark Savings: Stablecoin yield optimization channel

Spark Savings provides stablecoin holders with an accessible and highly stable yield solution. By allocating funds across DeFi, CeFi, and RWA (real-world assets) markets, the system maximizes annualized stablecoin returns through risk-adjusted deployment. - Spark Liquidity Layer: Liquidity provider for DeFi protocols

Spark’s liquidity layer serves as a stable capital source for other DeFi protocols, providing deep liquidity, ensuring market efficiency, and further boosting the sustainability of the on-chain financial ecosystem.

SPK Token Design and Distribution Plan

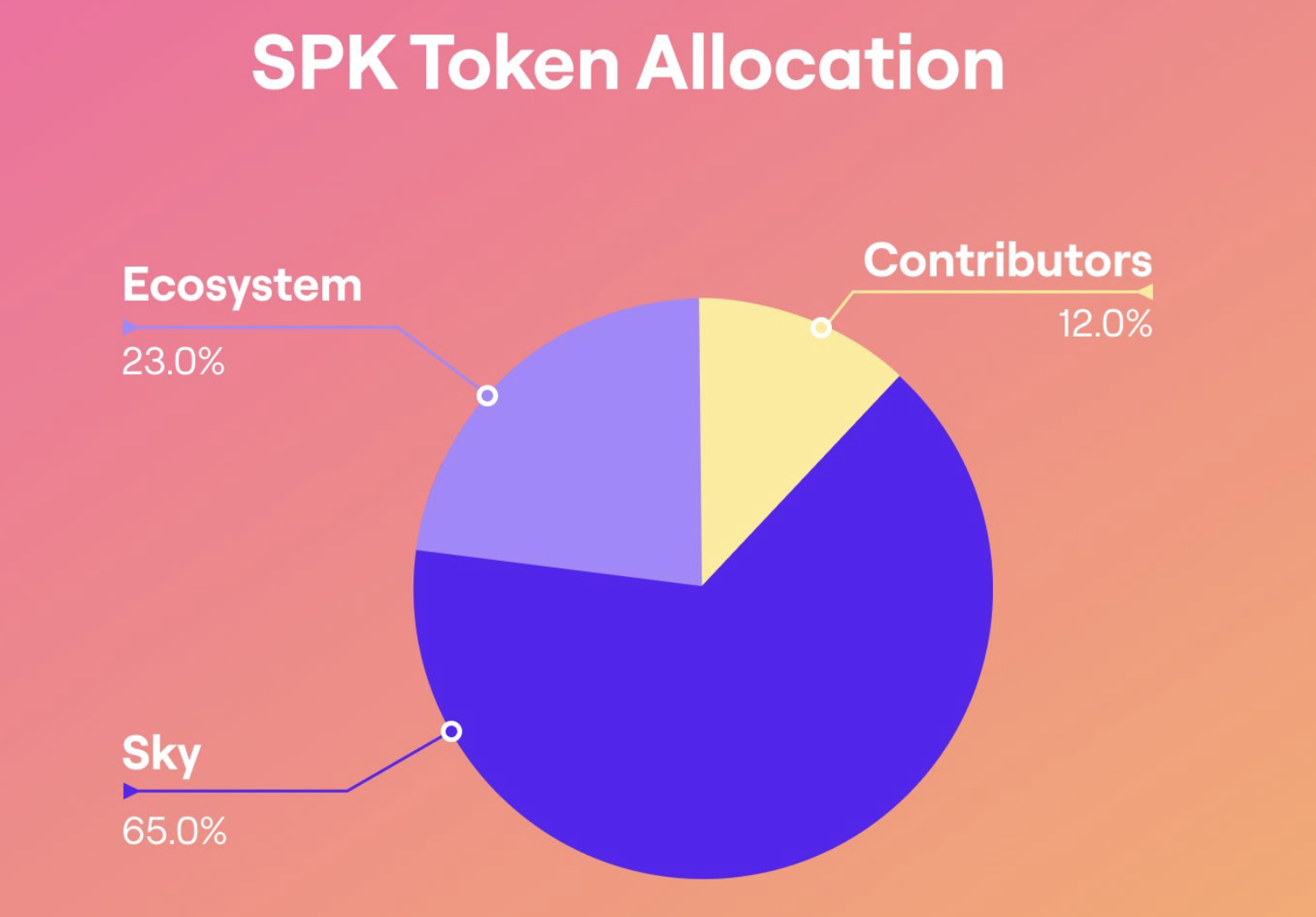

The Spark Protocol governance token, SPK, has an initial total supply of 10 billion tokens and plays multiple roles—including governance, incentives, and protocol security. The issuance and allocation model is designed for long-term sustainability:

Sky Farming Rewards (65%): Core user incentives distributed gradually over a 10-year period.

Ecosystem Development Fund (23%): Supports cross-chain deployment, technical development, and global expansion.

Core Team and Advisors (12%): Subject to a one-year lock-up and a three-year linear vesting schedule to ensure long-term contributor value.

(Source: sparkdotfi)

SPK also features a re-minting mechanism available only under special governance conditions. The DAO can activate this mechanism exclusively for situations such as bad debt liquidation. This ensures protocol security and transparency.

SPK Application Scenarios

Governance participation: SPK holders can join Spark DAO’s Snapshot voting to directly influence protocol strategies, asset support decisions, and incentive parameters.

Staking and protocol security: Staking SPK supports protocol operations and underpins security mechanisms, including insurance pools or validator layers, while providing the opportunity to secure future Spark sub-protocols.

User reward incentives: When users stake SPK, they earn Spark Points that they can redeem for rewards and potential airdrop entitlements within the protocol or partner platforms to drive community engagement and loyalty.

Multi-Chain Deployment and Market Scale

Spark is live on Ethereum, Arbitrum, Base, Optimism, Unichain, Gnosis Chain, and other networks, managing over $3.5 billion in stablecoin assets and generating more than $170 million in annual on-chain yield. This makes Spark one of the few DeFi protocols to achieve both significant scale and efficiency.

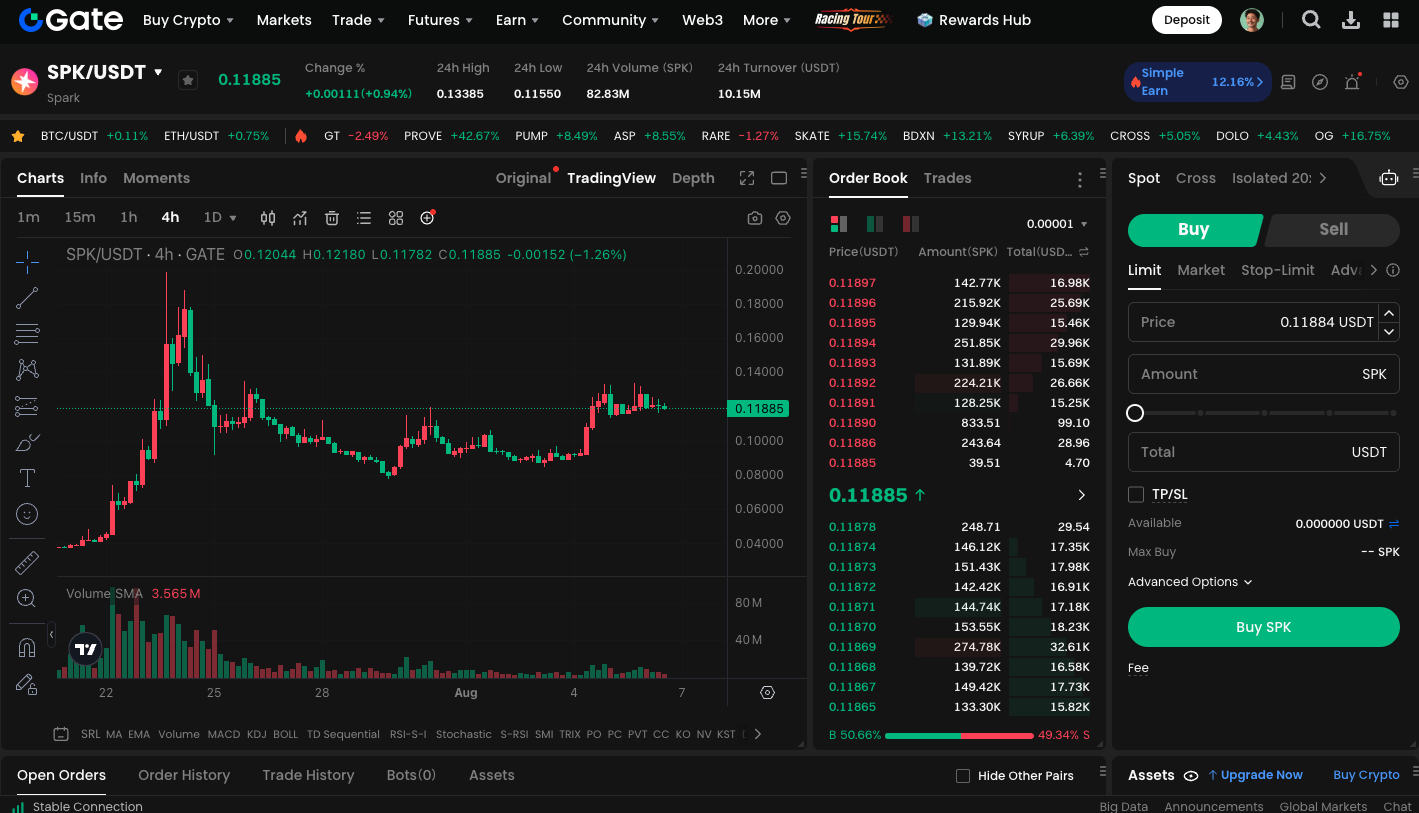

Start spot trading SPK now: https://www.gate.com/trade/SPK_USDT

Conclusion

Spark’s goal is not to replace existing DeFi protocols, but to integrate seamlessly into the on-chain financial system through a modular, collaborative approach. Its yield layer and liquidity core ensure capital is actively put to work and protocols operate in synergy—marking a new era of capital efficiency in DeFi. As SPK advances decentralized governance, deepens cross-chain integration, and fosters further innovation, Spark is poised to become DeFi’s foundational engine, providing sustained momentum for the blockchain financial sector.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025