Q2 Net Profit Hits $386M — Robinhood Rakes It In from Crypto Trading

On July 30, Robinhood, a leading U.S. fintech platform, released its Q2 2025 financial results, continuing its strong business momentum—especially with standout performance in its expanding cryptocurrency division.

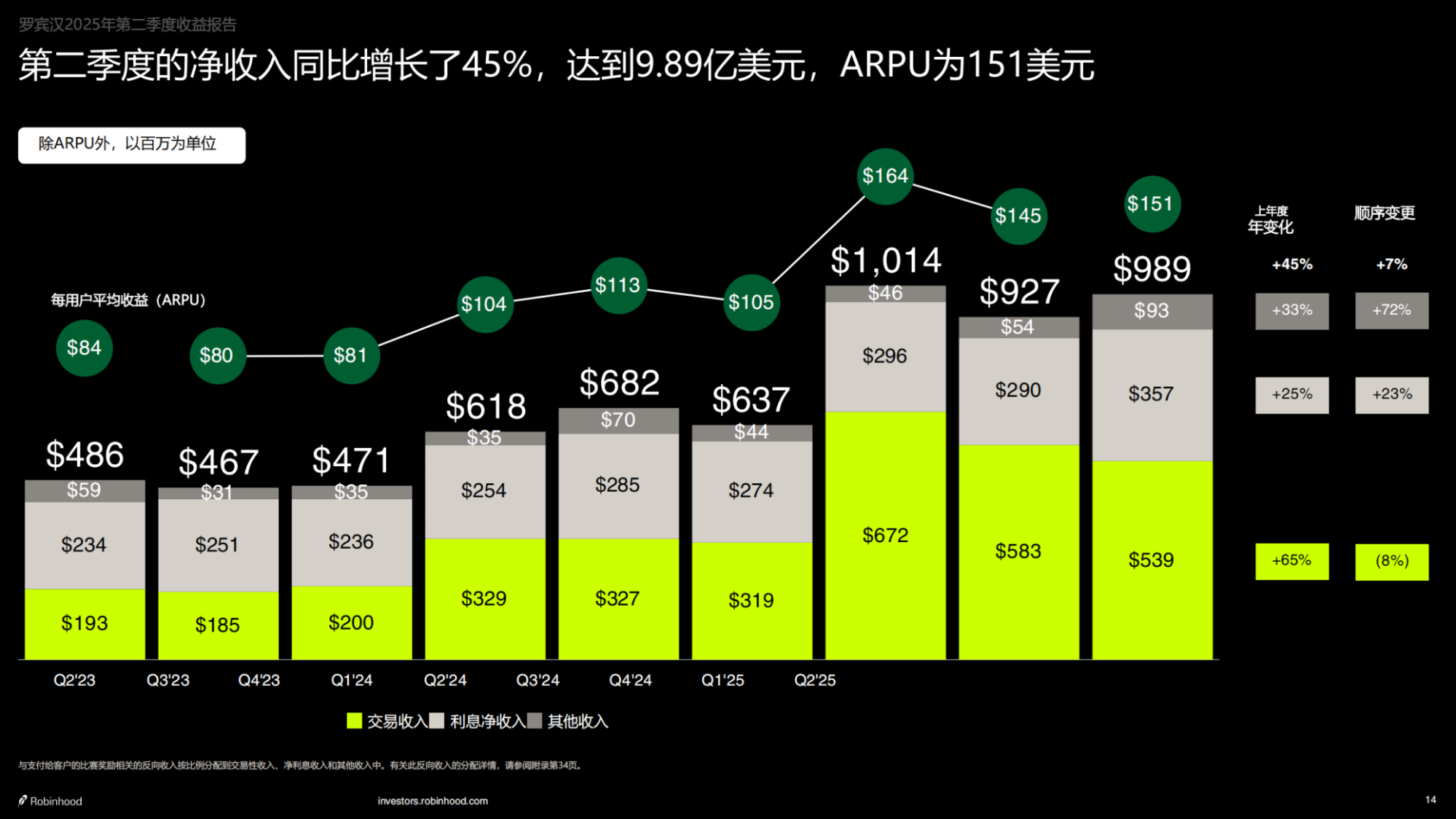

Total net revenue hit $989 million, marking a 45% year-over-year increase. Net income reached $386 million, up 105% from the same period last year. Diluted earnings per share doubled from $0.21 to $0.42 year-over-year. Robinhood delivered solid results across revenue, profits, and user growth this quarter.

Robust Quarterly Financials and Rising Platform Engagement

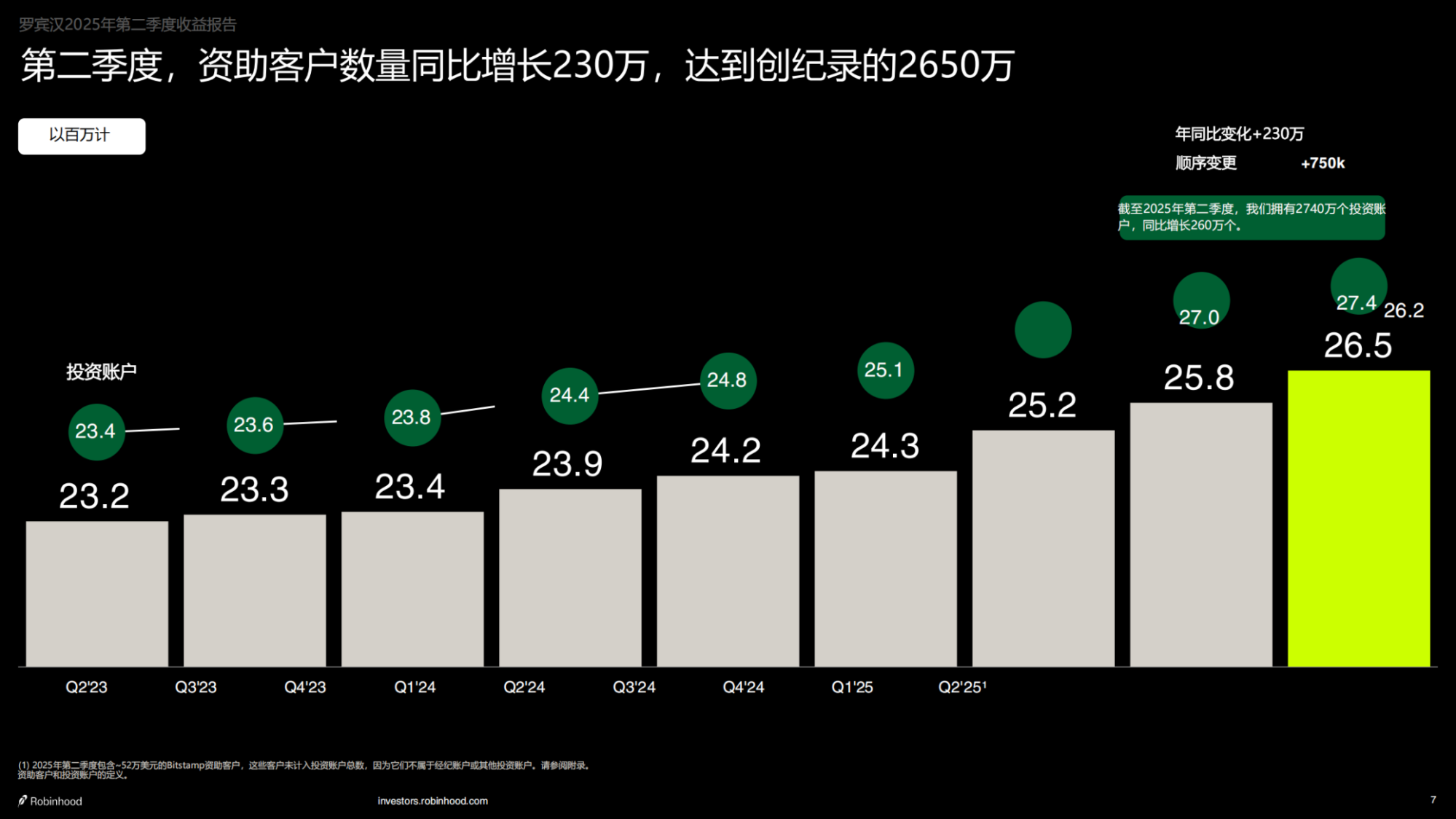

Active funded accounts on the platform climbed to 26.5 million, an increase of 2.3 million year-over-year, bringing total investment accounts to 27.4 million. A growing user base drove a sharp jump in assets on the platform. As of the end of June 2025, Robinhood’s assets under custody stood at $279 billion, nearly double from a year ago—a surge fueled by ongoing client net deposits and broad market recovery.

User activity also showed significant improvement. Average Revenue Per User (ARPU) was $151, reflecting 34% year-over-year growth. Net deposits this quarter came in at $13.8 billion, with a trailing 12-month sum of $57.9 billion—up 41% year-over-year. These numbers demonstrate strengthened customer loyalty and higher fund retention. Robinhood Gold subscriptions grew to 3.5 million users (up 76% year-over-year). Gold members pay $5 per month, driving an annualized subscription revenue of $176 million—providing a reliable source of recurring cash flow.

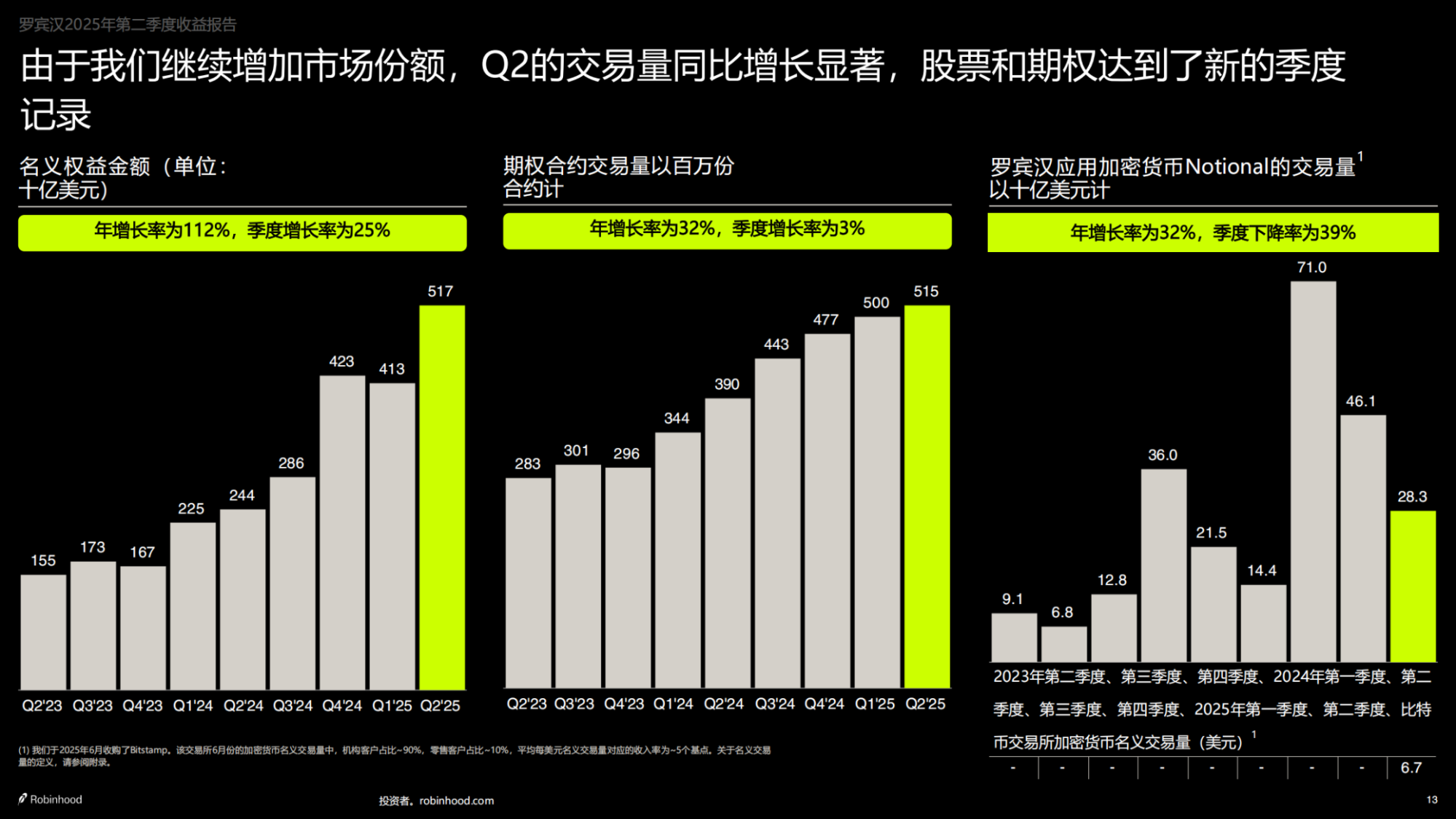

Trading activity was also at an all-time high: options contract volume hit 515 million, and notional equity trading reached $517 billion—both new records. Robinhood continues to invest in advanced tools for active traders, including enhanced charting, simulated return visualization, and sophisticated options analytics, further attracting the high-frequency trading community.

Crypto Business Surges, Bitstamp Acquisition Fuels Growth

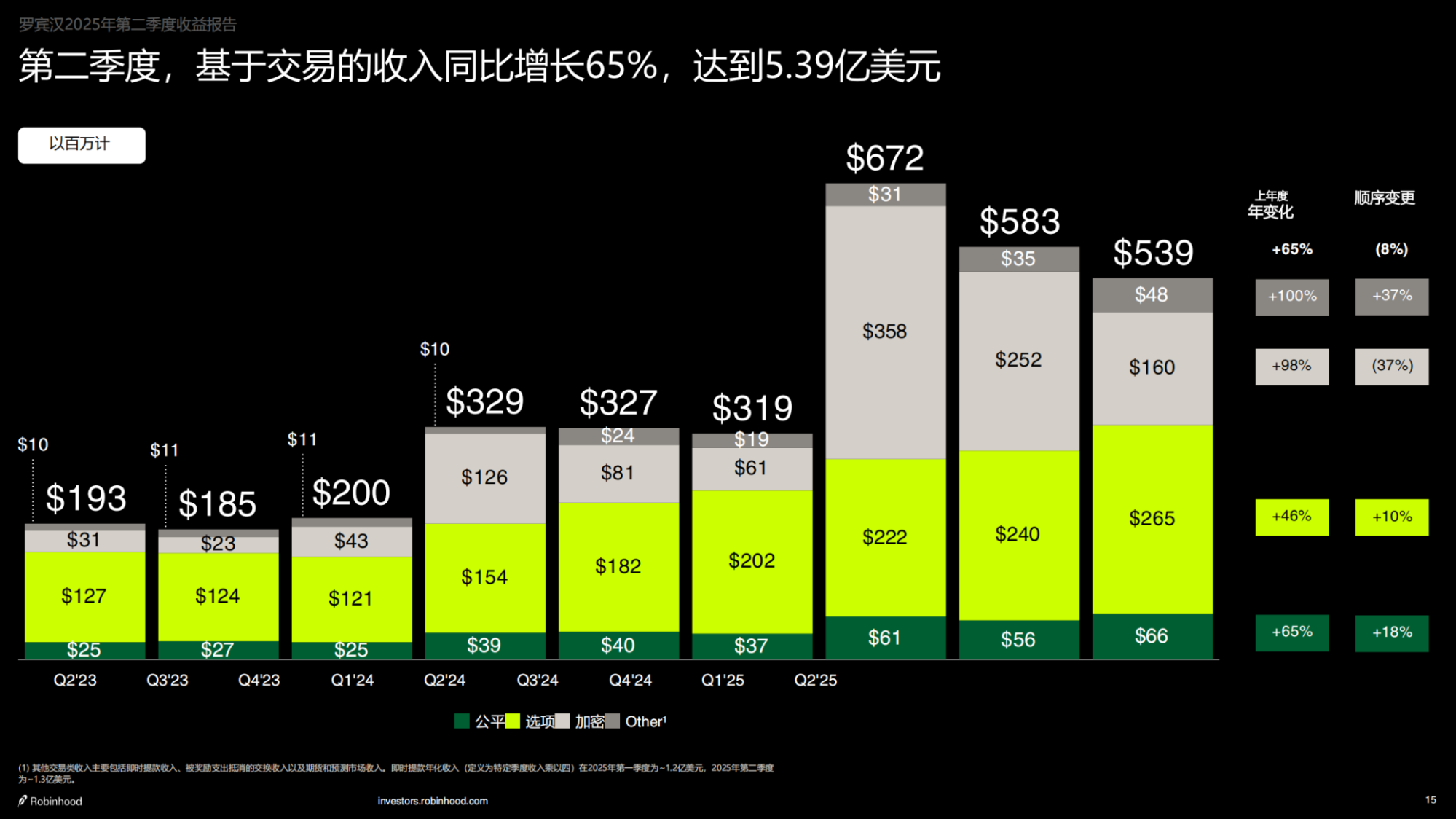

This quarter, Robinhood’s cryptocurrency business drew particular attention. Crypto trading revenue reached $160 million, soaring 98% year-over-year. Notional crypto trading volume in the Robinhood app was $28 billion, up 32% from last year. The June acquisition of Bitstamp added $7 billion in trading volume for the first time, now consolidated in Robinhood’s results. Altogether, Robinhood’s crypto trading volume for the quarter totaled $35 billion—making crypto the fastest-growing segment in its trading business.

By bringing Bitstamp under its umbrella, Robinhood not only expanded trading volume but also gained institutional trading channels and global regulatory access. Bitstamp boasts over 50 global crypto licenses. Ninety percent of its trading volume comes from institutional clients, and it charges an average fee of 5 basis points per trade. These institutional flows and licensing capabilities make Bitstamp a key contributor to Robinhood’s emerging revenue streams.

Beyond Bitstamp, Robinhood plans to finalize its acquisition of Canada’s WonderFi platform, with closing targeted for the second half of 2025. This move will extend Robinhood’s digital asset services in Canada and mark its expanded push beyond North America.

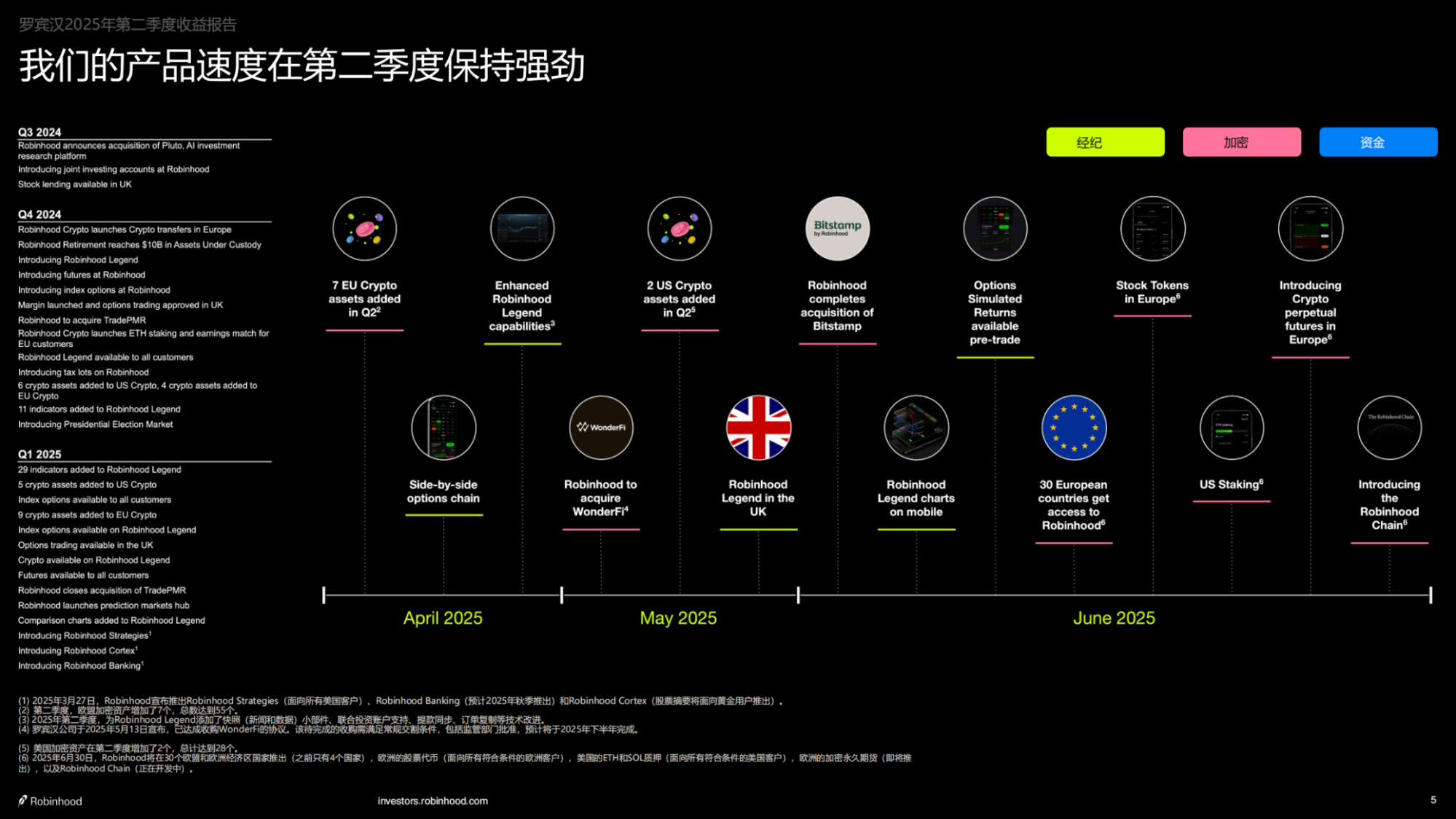

On the product side, Robinhood’s crypto segment continues to evolve rapidly. In Q2 2025, Robinhood expanded its crypto services to 30 European countries, up from just four last year. The firm also introduced “Stock Tokens,” enabling users in Europe to trade tokenized versions of more than 200 U.S. stocks and ETFs. In the U.S., Robinhood rolled out staking services for both ETH and SOL, and is preparing to introduce crypto perpetual contracts.

Robinhood is also developing Robinhood Chain—a core blockchain platform designed to power future on-chain trading and asset management. These initiatives extend Robinhood’s digital asset technology capabilities while enhancing its global compliance and broadening product diversity.

Expanding Business Boundaries and Diversifying Financial Services

In addition to trading and crypto, Robinhood is actively building a comprehensive product suite centered around account management and wealth tools. In Q2 2025, Robinhood Retirement account assets reached $19 billion—up 118% year-over-year. The growth of such long-term funds boosts asset stability and increases user lifetime value.

Robinhood Strategies, launched earlier this year, is gaining traction as a digital asset allocation service, currently managing more than $500 million for over 100,000 users—establishing a sizable pool of passively managed assets. The company is also rolling out the Robinhood Gold Card credit card. This quarter, 300,000 customers activated the card. Linking the card to both trading accounts and real-world spending increases the platform’s customer engagement and share of wallet.

On the expense front, total operating costs for Q2 were $550 million, up 12% year-over-year. Adjusted operating expenses stood at $444 million, keeping growth below 9%. Robinhood updated its full-year operating expense outlook: factoring in the Bitstamp acquisition, adjusted annual operating expenses and stock-based compensation are projected at $2.15 to $2.25 billion—slightly above the year’s initial target.

As of quarter-end, Robinhood held $4.2 billion in cash and equivalents, providing ample capital for ongoing expansion and share repurchase plans. The company has bought back $703 million in common stock over the past 12 months and intends to continue, adjusting the pace of repurchases in response to market conditions.

Future Roadmap

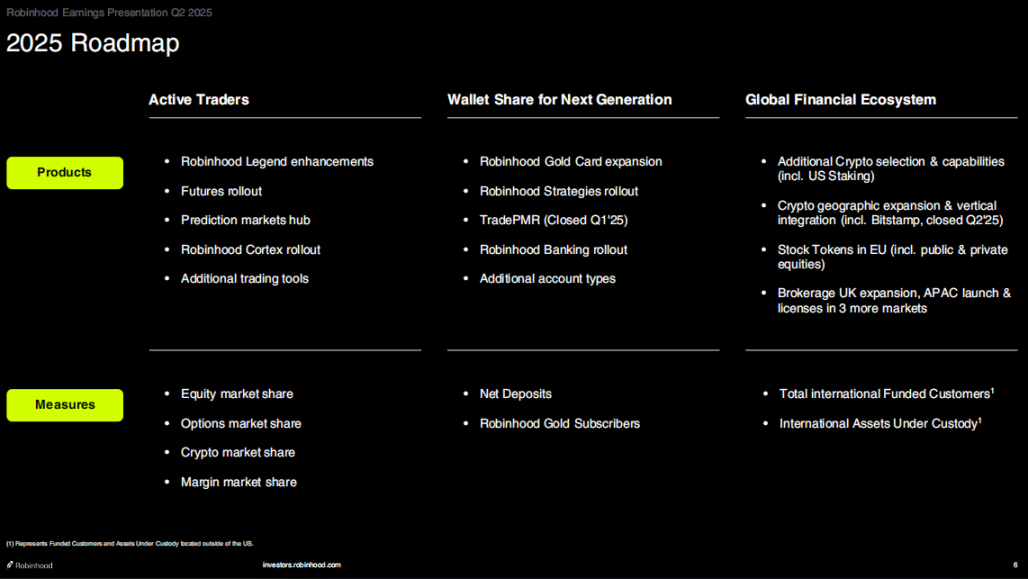

Robinhood’s financial report outlined three core focus areas for future growth: further advancement of trading tools, expansion of client assets, and international market development.

For trading tools, Robinhood will keep enhancing functionality for active traders. The upcoming Robinhood Legend suite will feature predictive market modules, simulated return tools, and cross-asset chart analysis—strengthening technical support for high-frequency users. The Cortex intelligence analytics system will also roll out in more use cases, helping clients make more informed investment decisions.

In accounts and fund management, Robinhood plans to launch Robinhood Banking in fall 2025, integrating checking, savings, and wealth management into a unified, closed-loop custody and payments platform. The company also plans to ramp up Gold Card issuance and connect it to the trading rewards program, further deepening user engagement.

International growth is a top priority for 2025. Robinhood is now live in 30 European countries and has launched localized trading in the UK. In the next few quarters, the company aims to enter Asia-Pacific markets and has already begun the financial licensing process in multiple regions.

On the crypto ecosystem side, Robinhood will continue to broaden its product scope—launching crypto perpetual contracts in Europe and advancing Robinhood Chain to build proprietary on-chain infrastructure. Once Bitstamp and WonderFi integrations are complete, Robinhood will have both institutional and retail crypto capabilities across Europe and North America, creating a strong foundation for its global strategy.

Disclaimer:

- This article is republished from [Foresight News], with copyright held by the original author [ChandlerZ, Foresight News]. If you have objections regarding republishing, please contact the Gate Learn Team. We will respond promptly according to our internal procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Unless Gate is expressly mentioned, translated versions of this article may not be copied, distributed, or plagiarized.