SEC releases new standards, will a wave of spot ETF approvals be on the horizon?

On July 29, the U.S. Securities and Exchange Commission (SEC) approved the in-kind creation and redemption mechanism for crypto asset exchange-traded products (ETPs). Previously, crypto ETPs primarily used cash creation and redemption models. This change significantly cuts trading costs and boosts efficiency. Additionally, the SEC released listing standards for spot ETFs, with the new rules expected to take effect in September or October 2025. These standards aim to streamline the listing process and pave the way for more crypto assets to enter mainstream financial markets.

Must Be Listed on Major Exchanges Like Coinbase for at Least 6 Months

The SEC’s new listing standards focus on qualification requirements and operational mechanisms for crypto ETPs. For the first time, in-kind creations and redemptions are formally permitted, meaning authorized participants can exchange ETP shares for actual crypto assets, not just cash. This approach can reduce tax liabilities, minimize friction, and boost ETF liquidity. In an official statement, the SEC Chair highlighted that this decision is designed to give crypto ETPs parity with traditional ETFs while preserving market integrity. Previously, crypto ETPs were required to use the cash model, resulting in higher operating costs and heightened manipulation risks.

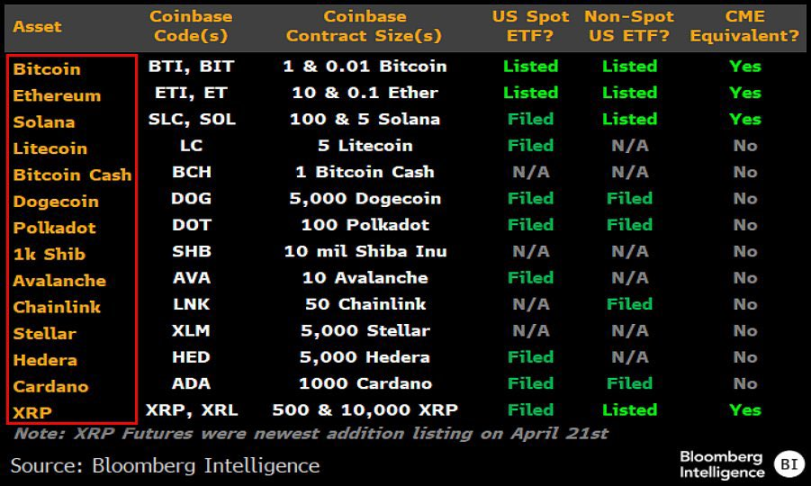

The SEC also established universal listing standards requiring that crypto assets be listed on major exchanges’ futures markets, such as Coinbase, for at least 6 months. This rule ensures assets have sufficient liquidity and market depth to prevent manipulation. According to documents cited by Phyrex, ETF issuance for tokens or meme coins (like Bonk and Trump Coin) without futures must comply with the 40 Act.

Which Projects’ ETFs Are Likely to Be Approved

Spot Bitcoin and Ethereum ETFs, approved in 2024 and 2025 respectively, will continue to benefit from the optimized in-kind mechanism.

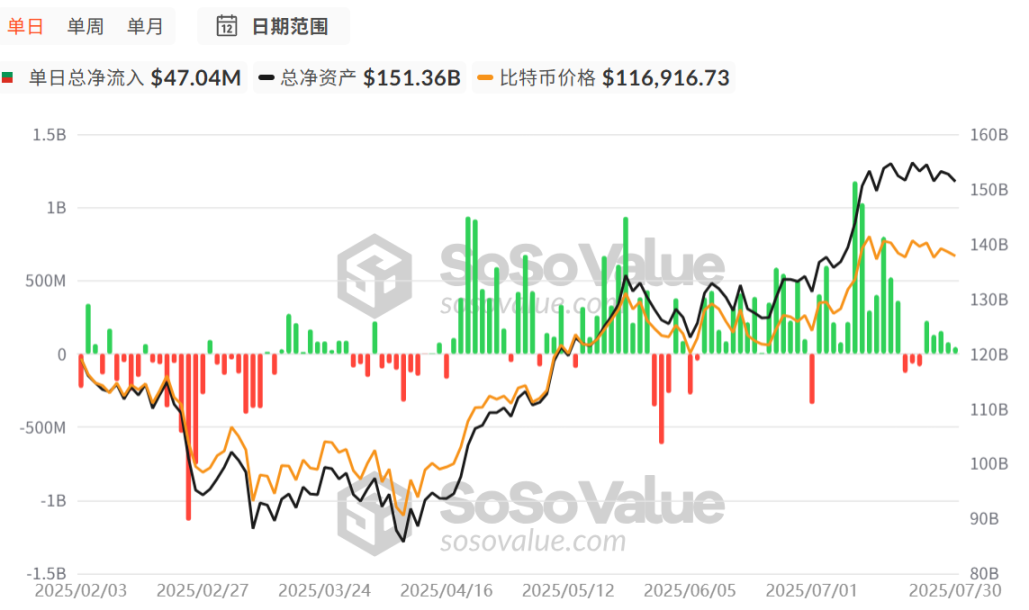

SoSoValue data shows that by July 31, 2025, U.S. spot Bitcoin ETFs had a total cumulative net inflow of $55.11 billion. U.S. spot Ethereum ETFs posted cumulative net inflows of $9.62 billion, surging after rebounding from a sluggish period. The approval of spot ETFs has clearly supported price increases in these tokens.

The new standards open the door for altcoins, with Solana (SOL) and Ripple (XRP) positioned as initial beneficiaries. Cboe’s proposal specifically mentions that SOL and XRP ETPs are slated for launch in Q4 2025, supported by active futures markets. XRP futures contracts went live on Coinbase on April 22 of this year, and XRP’s use in cross-border payments has attracted institutional interest. Analysts forecast a strong chance of these ETFs being approved, potentially before the end of 2025.

Other potential projects include Chainlink, Polkadot, and Cardano, which already meet the required listing duration and are supported by emerging futures contracts. Not all projects will qualify, however: DOGE may be excluded due to a lack of futures trading history unless market maturity improves. Overall, the new standards are expected to enable approval of 10-15 new ETFs covering the top 20 crypto assets by market capitalization, helping move the industry from speculation toward investment.

Coinbase Poised as Key Beneficiary

On May 9, Coinbase Derivatives, a Coinbase subsidiary, launched the first CFTC-regulated 24/7 leveraged Bitcoin and Ethereum futures trading service in the U.S. for both retail and institutional investors. This milestone marks the first time the U.S. derivatives market has offered round-the-clock trading, empowering users to hedge risk and seize market opportunities at any time. Coinbase plans to introduce perpetual contracts and expand its lineup of compliant derivatives products.

As the leading U.S. crypto exchange, Coinbase stands to gain substantially from the SEC’s new standards. First, the rules cite Coinbase as a benchmark for eligibility: tokens trading on the platform for over 6 months can apply for ETPs, deepening Coinbase’s influence in regulatory processes. This makes assets listed on Coinbase more easily translatable into ETF products, attracting additional issuers for collaboration. Coinbase already serves as custodian for several Bitcoin and Ethereum ETFs, with custody business revenue rising 30% in Q1 2025.

Second, the new standards are expected to boost Coinbase’s trading volume and revenues. The in-kind redemption mechanism requires ETF issuers to hold actual crypto assets, prompting institutions to execute large trades via Coinbase. Bloomberg analysts estimate this could net Coinbase an additional $1 billion per year in fees. As more ETFs roll out, retail investors are also likely to turn to Coinbase to purchase underlying assets, reinforcing a virtuous cycle of growth.

On February 21 of this year, the SEC dropped its lawsuit against Coinbase without levying any fines. With policy obstacles removed, Coinbase faces a clear path forward. The new standards bolster Coinbase’s legitimacy, shifting its status from regulatory adversary to collaborative partner.

CFTC May Gain Primary Approval Authority for Spot ETFs

The Commodity Futures Trading Commission (CFTC), as the federal commodities regulator, is playing an increasingly pivotal role in the spot ETF landscape. Since crypto assets such as Bitcoin are classified as commodities, regulation of spot ETFs requires coordination between the SEC and CFTC. In 2025, a White House policy report recommended closer collaboration between the two agencies, including the creation of a “safe harbor” to minimize overlapping supervision. Leadership vacancies at the CFTC have delayed some decisions, but this has created opportunities for crypto: the agency’s more permissive commodity framework could expedite spot ETF derivatives innovation. If the CFTC designates more crypto assets as commodities, spot ETF approvals could accelerate, easing the SEC’s securities review workload.

Currently, regulators appear to have reached a workable balance. As Twitter commentator qianbafrank commented, the new SEC standards mean “approval authority over crypto spot ETFs has shifted to the CFTC (Commodity Futures Trading Commission), because the CFTC is the main regulator deciding which assets can have futures contracts.”

However, CFTC influence comes with challenges: increased manipulation in crypto futures markets could lead the CFTC to tighten oversight, which may slow spot ETF progress. By 2025, the CFTC had already prosecuted several crypto fraud cases, potentially requiring ETF issuers to meet stricter reporting obligations.

Disclaimer:

- This article is republished from Foresight News, with copyright held by the original author 1912212.eth, Foresight News. For concerns regarding this reprint, please contact the Gate Learn Team, who will address your concerns promptly in accordance with our procedures.

- The views and opinions in this article are solely those of the author and do not constitute investment advice.

- Other language versions were translated by the Gate Learn Team. Unless Gate is cited, any copying, distribution, or plagiarism of these translations is prohibited.